We all want the next year to be the best year yet, but it doesn’t just happen! Thoughtful goals and resolutions for the New Year are needed as well as important actions to set up for a successful year so I’m sharing my go to tips n preparing for a great new year, including some help from American Family Insurance!

Start the New Year Off on the Right Foot by Preparing for Success!

We are only a couple weeks away from another new year, so the inevitable reflection process has begun on this past year and the goal setting process for the year to come. While I believe in and practice continued goal setting throughout the year more than “New Year Resolutions”, i do take time after the holidays to set myself up for success by putting a few organizational things in place. It starts the New Year off on the right foot and definitely helps refocus priorities after the holiday craze.

So here are a few of my go to actions that help me be successful in the New Year!

Clean and Purge

We bring so many new things into the house in December that I feel it’s also a good time to also get rid of things. It also helps make room for the new! Therefore, I start going through different areas of the house beginning in October as I have time and making 4 piles that I can then easily take action on: Put Away, Reorganize, Donate and Toss. We have even begun this process with Liam and are donating some duplicate toys or toys he doesn’t play with anymore to make room for new ones.

This is also the time I go through any piles of paper that have slowly been built up, especially with higher rates of mail during the holiday season, and get all paperwork in place for both personal and work and impending taxes.

Evaluate your Goals

Look at the goals you are currently working on and identify the goals you feel you’ve successfully completed and the areas you still need to progress on . I find it helpful to identify immediate goals, short term goals and long term goals. Write them down with a date that you should evaluate your progress and then put that date into your planner, phone or whatever tracking system you use. Goals are useless in my opinion if we don’t revisit them and hold ourselves accountable.

Put Processes in Place

Keeping your goals in mind, identify processes that you can set in place now to be successful in the coming year. Doing this immediately is important if you want to start out working on your goals in January instead of maybe preparing in January and working at your goals in February or even later. For example:

- If you want to start saving money each month into a separate account, go to the bank and set up a savings account now before the year begins. Otherwise, you’re more likely to not start in January and forget about it by May. We have an appointment this week to start a savings account for Liam – one of our 2018 goals!

- If you want to manage your money differently in the new year, evaluate your budget now so you don’t already start behind. The first step is evaluating what your monthly income is, what your monthly bills are, and what you normally spend on other expenses every month so you can assign every dollar a job. Then decide how you will track this budget.

- If you want to keep your papers more organized, create the physical system now that you will use.

- If you want to cut your grocery budget (another 2018 goal for us), then start brainstorming inexpensive meal ideas now and evaluate your recent grocery spending. I’m creating a list of budget meals as well as meals that produce a lot of leftover meals and I’m going to test two different options for ordering groceries for pick up or delivery because I think that seeing how much I am spending as I add things to my cart will help me keep expenses down.

Choose Accountability Partners

Whether it’s a friend taking a fitness class with you, a colleague you check in with once a week at lunch, or your spouse asking about water intake or budget progress, having people to help hold you accountable is helpful for staying on track. Accountability Parters should be carefully chosen though because they are not all created equally. Really think about who is going to be focused, supportive, knowledgeable, and reliable. But maybe most important – who won’t let jealousy get in the way and who wants you to be successful as much as you want them to also be successful.

Join Programs For Education and Reflection

Enter American Family Insurance and their DreamKeep Rewards. It’s an interactive experience that rewards you for reading short articles followed by either a few questions that ask you to reflect or a small activity that asks you to take immediate action on the topic of the article. With the New Year right around the corner, it’s a great time to join because many of the activities might coincide with goals and resolutions that you might make – creating a budget, protecting your home and family, planning a family vacation and more.

With your goals in hand for the coming year, this program can really help you be more successful without a lot of time required for each activity. For us, it’s been a great support system for some big changes we have been working through – becoming a family of three, ensuring we are properly covered and protected in worse case scenarios, discussions on buying a house, planning for more kids, and more! So many possibilities and big decisions these days!

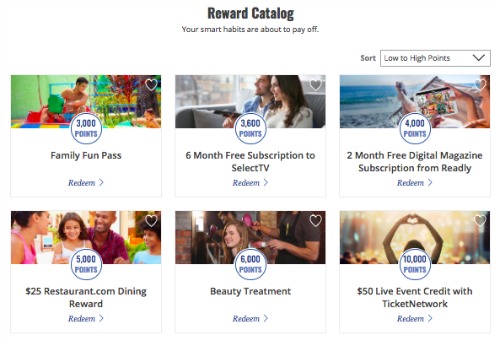

While working through these activities, we also earn points for DreamKeep Rewards, which can eventually be used for things like passes to local activities, restaurant.com gift cards, spa treatments, and more. The best part? The points really do add up quickly. I’ve done reward programs before where it feels impossible to attain any of the tangible rewards, but after signing up and completing just a few activities, we already had enough points for a restaurant.com gift card.

Seeing your reward options is easy with a reward catalog that’s easy to navigate – clear point requirements, reward descriptions, and sign up instructions. Plus, there is such a wide variety of choices. Currently we are debating if we want to use points for a reduced movie ticket membership or a free hotel night.

But the real benefit is knowing we are on track for our goals and having help doing so! Plus I love knowing that the things that matter most in my life are protected while I dig in and focus on big goals for the New Year. Could you use some extra knowledge and support? Do you feel protected? Make sure to sign up for the FREE DreamKeep Rewards from American Family Insurance!

Leave a Reply